- Have FinJinni write these Journal Entries back to QuickBooks.

- Keep the Journal Entries in FinJinni’s reporting database without updating QuickBooks. They will appear in all of FinJinni’s reports but your QuickBooks company will not be modified.

This feature is only available if you have purchased the license for the FinJinni Importer advanced data loading feature. It is enabled in the trial versions so that you can preview it.

FinJinni’s will load journal entries from CSV-format files that you can create with Excel. There are separate files for each QuickBooks company and you may have multiple files for one company. All files should be saved in the folder “documents”\My Templates\FinJinni, where “documents” is your normal documents folder.

The data files that FinJinni will load are named “companyid_journal_[suffix].csv”, where “companyid” is the company identifier (aka nick-name) that you assigned when you added the company to FinJinni and “suffix” is a value to uniquely identify the file if needed – you can pick anything you want for this, such as a year.

The FinJinni Excel Add-In can assist in saving these CSV-format data files from Excel worksheets. Once you create a worksheet with the columns described below, use the Upload button on the FinJinni ribbon bar in Excel to save the worksheet as a CSV file. You can also save it using the normal Excel menu – the FinJinni Upload button is a convenient shortcut.

These files have the following columns and require a header with the column name in the first row:

- TxnDate

The date for the transaction.

- RefNumber

The Journal Entry number. This must be unique to a single Journal entry.

Multiple line items for the Journal Entry must have the same transaction date and reference number. Each line item occupies a separate line in the data file and all line items must be in sequence.

- Account

The account name or description (in the format “number – name”). This can also be the full name for an account (in the format “parent:child” used by QuickBooks). Any of these formats that uniquely identifies the account is sufficient.

- Amount

The amount.

- DebitOrCredit

“D” or “Debit” for a debit, “C” or “Credit” for a credit.

- Description

The description (memo) for the line item. This value is optional.

- Memo

The memo field value for the transaction. This value is used for QuickBooks online only and is optional.

- PostBack

“1” to write back this journal entry to QuickBooks. “0” or blank to leave it in FinJinni’s reporting database without modifying QuickBooks.

- IsAdjustment

“1” if this should be marked as an adjustment entry in QuickBooks, “0” or blank otherwise.

- Revised

“Y” to revise an existing QuickBooks journal entry. “N” or blank otherwise.

Note: You can change the values on FinJinni’s journal entry at any time. However, changed values will not be normally written back to QuickBooks after the journal entry is initially added. If you set this field to “Y”, FinJinni will update the journal entry in QuickBooks on the next refresh regardless.

Revised journal entries cannot have new line items. If you need to add new line items, void the journal entry and create a new one.

- Voided

“V” to void an existing QuickBooks journal entry (note: “V” not “Y” here). “D” to delete an existing journal entry. Otherwise leave blank.

- Class

A class name. If you have parent & child classes, this must be the full name in the format “parent:child”. This is an optional column, omit or leave blank if not used.

- Customer

A customer, or full sub-customer name in the format “parent:child”. Projects or jobs are sub-customers and need their parent customer identified. This is an optional column, omit or leave blank if not used.

- Vendor

A vendor name. This is an optional column, omit or leave blank if not used.

Usage Notes:

- Journal entry files are automatically loaded whenever a refresh is performed. FinJinni will detect whenever the file is changed (or a new file is added) and load the file.

- If you want FinJinni to write back Journal Entries to QuickBooks, you must select the option “Enable Write-Back to QuickBooks” on the company setup screen.

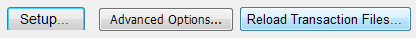

- You can perform an initial load manually, using the Advanced Options button on the Setup screen, that options screen has a “Reload Custom Budget File” button – i.e., press these buttons in sequence, then choose the option Reload Custom Journal Entry Data:

Note: This manual load does not immediately write back journal entries to QuickBooks if that option is chosen. The journal entries are recorded in FinJinni and written back to QuickBooks the next time that a refresh is performed.

- FinJinni does not check for Journal Entries in balance. For Journal Entries written back to QuickBooks, this check is performed by QuickBooks.

If QuickBooks cannot record the Journal Entry due to an error (such as the entry not in balance), FinJinni will not display an error. Instead, a log file is created in the My Templates folder with the error message contained in that file. The file is named “companyid_JournalEntries.Log”.

You can also check the status of all user-defined journal entries from Excel using the FinJinni Query “User-Defined Journal Entries” under the section “System Information Queries”.

Creating Multiple Company Data Files in Excel

You can use the FinJinni Upload function in Excel to create multiple data files from a single Excel worksheet. To use this feature in this way, add a Company_ID column as the first column of your worksheet and choose select “Multiple Companies & Fields” from the company drop-down on the upload screen. FinJinni will separate the rows into their appropriate company files.